MORE THAN INVESTMENTS

Jim Shellenberger, CFA | Financial Advisor

I wanted to take the time this month to remind you of the many offerings we have outside of investment management. Our intention is always to offer a comprehensive package of tools for you and your financial situation. Below, you will find some of the offerings we have available to you. Consequently, if there is ever a financial situation, you would like help evaluating, please don’t hesitate to reach out.

UTMA (Uniform Transfers to Minors Act): We offer a free UTMA for any child under the age of 18 up to a $10,000 account. A UTMA is a taxable investment account for minors. UTMAs help adults save and invest money for a minor until they reach a certain age where the account will transfer over to them. UTMAs are an excellent way for adults to gift money to children and give them a jump start for school or life if they choose not to go to school or don’t need money for school. They are also useful to help teach kids about investing and allow them to learn to contribute to an account at a young age. Some parents will match what their child contributes, which replicates a 401k and teaches children that they can “double” their money right off the bat; this is a great way to educate your children about saving.

Financial Plan: We can work with you to develop a financial plan. We utilize software called eMoney to collect information and run different scenarios. eMoney is a comprehensive financial planning software that helps with goals-based planning, cash flow planning, analyses, and projections. A financial plan will help you see a snapshot of where you are today and if you are on the correct path for where you want to end up. We can also bring in our expertise and bring attention to factors you may not have considered and look at your financial picture holistically. We encourage working with attorneys and accountants as they are part of the entire financial picture.

Donor-Advised Fund: We can help you set up a donor-advised fund. Some people describe a donor-advised fund as a charitable investment account. Once you contribute to the donor-advised fund, you are generally eligible to take an immediate tax deduction. After the contribution, you can invest the money and let it grow tax-free. From there, you can donate to a 501(c)(3). These funds can be beneficial for long term philanthropic goals. However, you can utilize them to donate away highly appreciated securities and replace them with the cash you would have given. This approach allows you to reduce unrealized capital gains and get your tax deduction simultaneously.

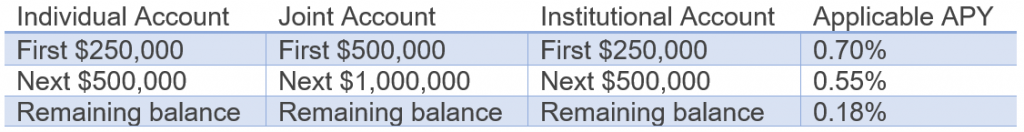

High Yield Savings Account: We offer a high yield savings account through a company called Flourish Cash. Flourish will allocate your money to their FDIC-member Program Banks. What this means is they have partnerships with about eight different banks where they deposit your money. An individual can get up to $2 million FDIC coverage, and a couple can get up to $8 million. Right now, the rate tier is as follows:

The rate tier can and will change over time. With the Fed Funds Target Rate at 0%-0.25%, the banks in this program may have to lower the APY they are offering at some point. If the Fed Funds Target rate increased, we might see the rates go up.

If any of these offerings seem of interest to you or you would like to know more, please reach out. We strive to be a resource for you. If you ever have any financial questions or want a second set of eyes to look over things, we are here to help.

Ready to talk?

Please reach out to set up an appointment.

Neither Elevate nor Frontier has any affiliation with any author, company or security noted within.

Past performance is no guarantee of future returns. Nothing presented herein is or is intended to constitute investment advice or recommendations to buy or sell any types of securities and no investment decision should be made based solely on information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for an s investor’s financial situation or risk tolerance. Diversification and asset allocation do not ensure a profit or protect against a loss. All performance results should be considered in light of the market and economic conditions that prevailed at the time those results were generated. Before investing, consider investment objectives, risks, fees and expenses. All calculations of performance are by Frontier.

Information provided herein reflects Frontier’s views as of the date of this newsletter and can change at any time without notice. Frontier obtained some of the information provided herein from third party sources believed to be reliable, but it is not guaranteed, and Frontier does not warrant or guarantee the accuracy or completeness of such information. The use of such sources does not constitute an endorsement.

Exclusive reliance on the information herein is not advised. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell any securities, commodities, treasuries or financial instruments of any kind. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, investment or tax advice.

Elevate Asset Management is wholly owned and operated by Frontier Asset Management, LLC. Frontier’s ADV Brochure is available at no charge by request at info@frontierasset.com or 307.673.5675. Our ADV Brochure contains important disclosure information and should be read carefully. 063021CST063022