“Free and Easy Down the Road I Go”-Dierks Bently

Jim Shellenberger, CFA | Financial Advisor

By the very definition of investing, we set aside money to build wealth over time. Most of us approach an investment and hope to make money or “let our money go to work for us.” Ideally, we make money with minimal ups and downs (volatility). Generally, this goal can, in part, be accomplished through diversification. Diversification is an investment approach that seeks to reduce exposure and risk to similarly behaving asset classes by combining a variety of investment options as a pool of assets. It’s basically the epitome of the simple advice we’ve all heard “don’t put all your eggs in one basket”. Additionally, in theory, some investment options should react differently to the same event. I wouldn’t describe anything in investing as “free and easy,” but in an ideal world, diversification in your investments can help you feel “[confident] and easy down the road I go.”

There Hasn’t Been a Consistent “Easy” Choice: When looking year to year, different asset classes outperform and underperform each other. The chart below is a great visual representation of how various asset classes perform against each other, on an annual basis. You can see that among the asset classes below, no category was top-performing over consecutive years. Long-term treasuries and aggregate bonds usually did best when stocks were negative. This type of behavior is what our research would suggest and reinforces our belief in diversification. You want different asset classes to act differently to each other depending on the market environment.

Source: Morningstar. This example does not represent all asset classes.

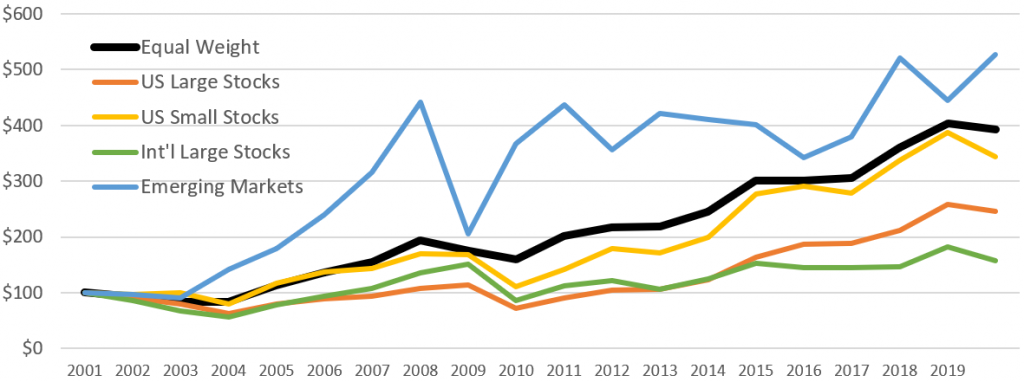

Smooth the Ride. When you look at the chart above, you can see there is some risk in placing all your money in a single asset class, especially since the future is unpredictable. Investment professionals can make educated forecasts, but things like pandemics and other Black Swan events are difficult to foresee. If you look at the chart below, we took the different equity asset classes from above (US large, US small, international large and emerging markets) and graphed them from 2001 to 2019. The bold black line is an example of a diversified portfolio with equally weighted positions of the four categories. It was the second-best performer over the time period, only behind emerging markets. This illustration goes to show the power of diversification and how a simple equally weighted portfolio could have increased your chances of a better return.

Source: All calculations by Frontier

Diversification to The Rescue. 2020 started as one of the strangest years in recent history for the stock market and things are still not back to “normal”, whatever that is. We all know the stock market was not spared from the chaos as stocks took a big hit, but diversification was there to help. In the chart below, you can see the returns for the different broad asset classes for the first quarter of 2020 and from the beginning of the year through the end of June. All the equities were down over 20% during the first quarter. Aggregate bonds were up about 3%, and impressively, long-term treasuries were up about 21%. People often ask me about bonds in their portfolios. In moments like this, when things work out as expected, bonds can be useful in that they often react differently to the same event and can help offset losses.

Source: All calculations by Frontier from Morningstar data.

Diversification is not the answer to everything in investing, but we believe it is a necessity for building a healthy, long-term portfolio. Our goal is to try to anticipate the return, volatility, and correlation of the asset classes to build a portfolio that seeks to maximize return for a given risk level. Hindsight is 20/20. So, until we discover a crystal ball to unlock the mysteries of the future, we will rely on diversification to help us say “[confident] and easy down the road I go.” Enjoy the ride.

Ready to talk?

Please reach out to set up an appointment.

Past performance is no guarantee of future returns. Performance discussed represents total returns that include income, realized and unrealized gains and losses. Nothing presented herein is or is intended to constitute investment advice or recommendations to buy or sell any types of securities and no investment decision should be made based solely on information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for an s investor’s financial situation or risk tolerance. Diversification and asset allocation do not ensure a profit or protect against a loss. All performance results should be considered in light of the market and economic conditions that prevailed at the time those results were generated. Before investing, consider investment objectives, risks, fees and expenses. All calculations of performance are by Frontier.

Information provided herein reflects Frontier’s views as of the date of this newsletter and can change at any time without notice. Frontier obtained some of the information provided herein from third party sources believed to be reliable, but it is not guaranteed, and Frontier does not warrant or guarantee the accuracy or completeness of such information. The use of such sources does not constitute an endorsement. Data sources for funds and indices is Morningstar.

Exclusive reliance on the information herein is not advised. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell any securities, commodities, treasuries or financial instruments of any kind. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, investment or tax advice.

In reviewing the performance information presented here, we recommend that you consider both the returns generated and the level of risk that was assumed in generating those results. We believe that performance information cannot be properly assessed without understanding the amount of risk that was taken in delivering that performance. The performance information presented here covers different time periods. We present performance information for short time periods because we understand that clients and potential Investors are interested in this information, however, we recommend against making any investment decisions based on short-term performance information. For any investment products mentioned herein, a complete description of their investment objectives, along with details of the risks and fees involved is contained in their respective prospectus and statement of additional information, which is available on their websites and should be read fully.

It is generally not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any) based on that index.

| INDEX | INDEX DESCRIPTION | |

| US Large | S&P 500 | Represents U.S. large company stocks. It is a market-value-weighted index of 500 stocks that are traded on the NYSE, AMEX, and NASDAQ |

| US Small | Russell 2000 | The Russell 2000 Index which measures the performance of the small-cap segment of the U.S. equity universe. |

| Int’l Large | MSCI EAFE | Measures international equity performance. It is comprised of the MSCI country indexes capturing large and mid-cap equities across developed markets in Europe, Australasia and the Far East, excluding the U.S. and Canada. |

| Emerging Markets | MSCI EM | Measures large and mid-cap equities across 23 Emerging Markets (EM) countries which include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. |

| LT Treasuries | Barclays Capital Long U.S. Treasury | Includes all publicly issued, U.S. Treasury securities that have a remaining maturity of 10 or more years, are rated investment grade, and have $250 million or more of the outstanding face value |

| AGG | Barclays US Aggregate Bond | Measures the performance of the U.S. investment grade bonds market. The securities must have at least one year remaining to maturity, must be denominated in U.S. dollars and must be fixed rate, nonconvertible and taxable. |

Frontier’s ADV Brochure is available at no charge by request at info@frontierasset.com or 307.673.5675.

Frontier’s uses of external sources in no way be considered an endorsement. Reader accesses sources at their own risk. Frontier is not responsible for any adverse outcomes from sources provided and cannot guarantee their safety. Frontier does not have a position on the contents of site sources. Frontier does not have an affiliation with any author, company or security noted within. Frontier reserves the right to remove these links at any time without notice. 063021CST063022