“I could have missed the pain, but I’d have had to miss the dance.” – Garth Brooks

Jim Shellenberger CFA, CFP® | Financial Advisor

Pain in any fashion is not enjoyable. While it can lead to better outcomes on the other side, in the moment, it doesn’t feel like that will be the case. If you are like me, you wish we didn’t have to experience the pain of financial market drawdowns. However, if we want to enjoy the times when the markets are going up, we will have to encounter times of pain during drawdowns. That is just the dance of the investing.

The pain we feel when the markets go down is the reason why Zephyr Associates developed the Pain Index. The greater the drawdown (Depth), the longer period of time before the investment turns positive (Duration), and the number of times an investment goes negative (Frequency) leads to a larger Pain Index. This is an excellent tool because, in 2020, we didn’t feel that much pain even though the markets went down a lot. Luckily in 2020, the markets recovered very quickly, which backs the idea of the Pain Index in that we feel more pain the farther the market goes down, the longer it is down, and the more often it is down.

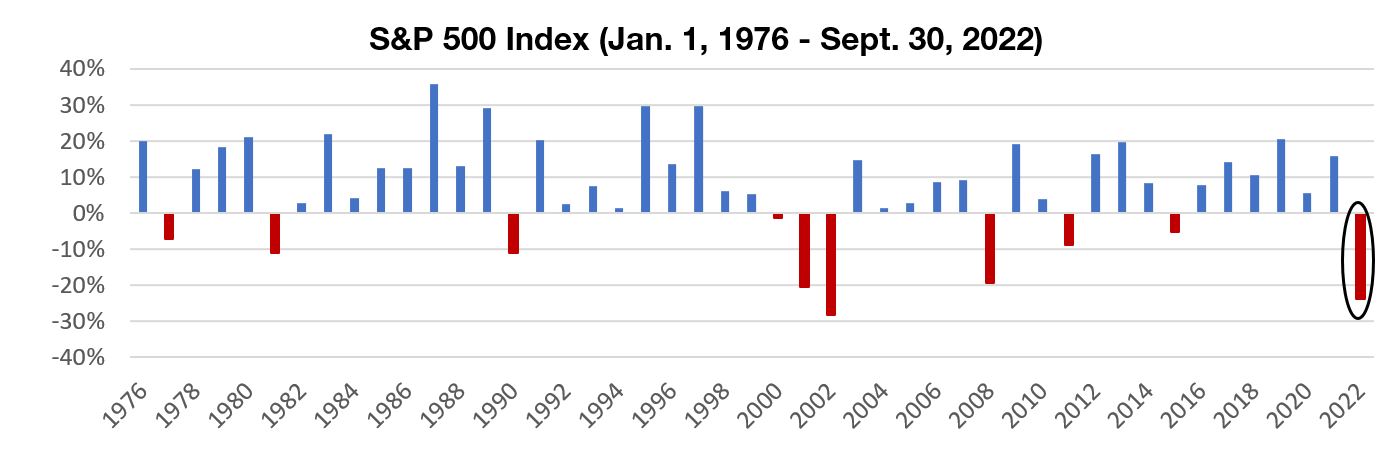

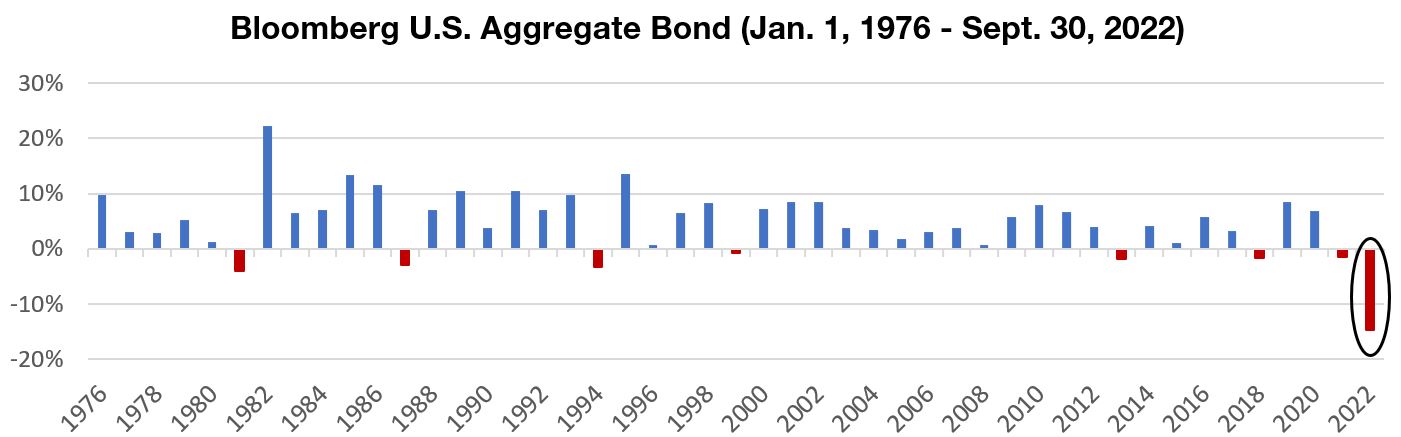

I would argue that we have felt more pain this year because diversification has been difficult. Most everything has been down this year. For example, from January 1 to September 30, the S&P 500® Index was down about 24%, the Bloomberg U.S. Aggregate Bond Index was down about 14.5%, and then gold which has historically done well during times of financial fear and at times of high inflation, is down about 9.5%. There has been nowhere to hide this year. This led me to look at how U.S. large stocks and U.S. aggregate bonds have done in the first nine months of each year, going back to 1976.

Data source: Morningstar. Data calculations source: Elevate. Through September 30, 2022.

Data source: Morningstar. Data calculations source: Elevate. Through September 30, 2022.

You may or may not be able to notice that this is the second worst start to the year for the S&P 500 Index, only falling behind 2002 and the worst start to the year for the Bloomberg U.S. Aggregate Bond Index by a decent amount. The problem is that you can since 1976, stocks and bonds haven’t been down this much before at the same time. Usually, one would hold bonds to offset the risk of stocks because, at times when stocks go down, people invest in bonds for safety, and then bonds go up in value. Unfortunately, that has not been the case so far.

Now, I would like to state that this information is now historic. It has happened, and we cannot change what has happened. The question to ask is: What is going to happen in the future? A quick side note that may help is that even though the S&P 500 is down about 24% year-to-date through September, if we look at the 3-year annualized return of the S&P 500, it is still 8.2%. That means the S&P 500 is up about 27% from 3 years ago.

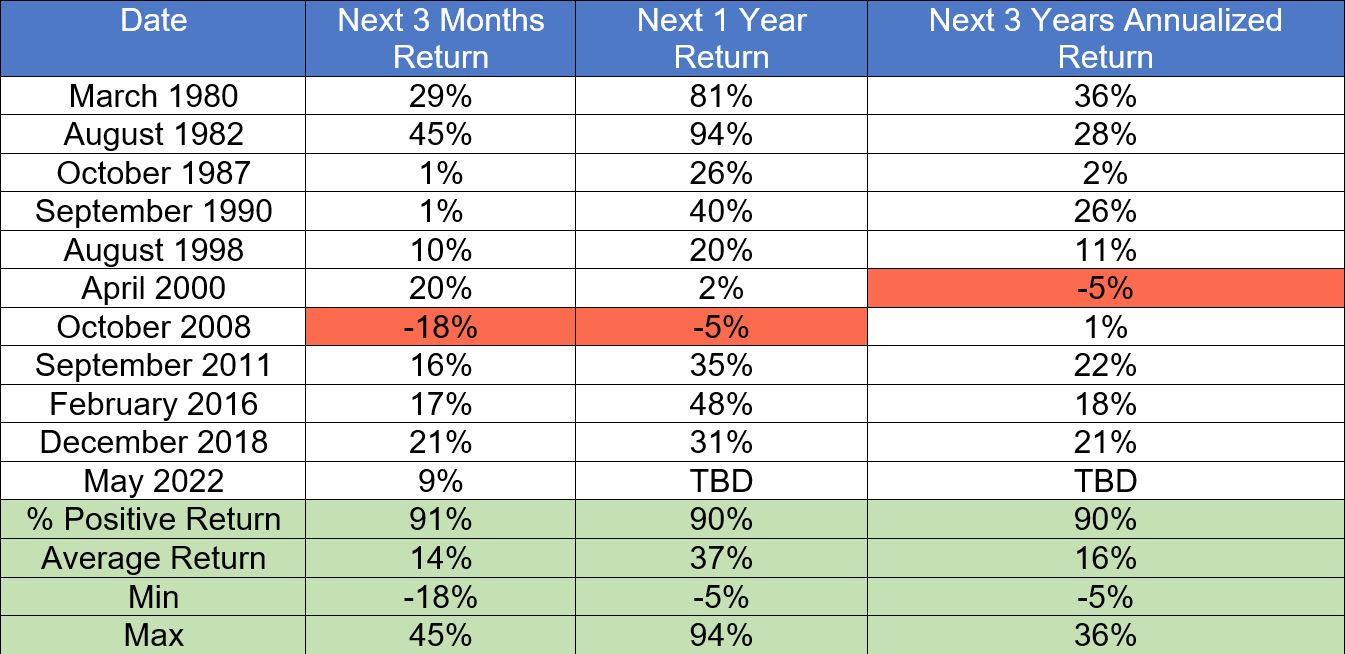

Now I do want to do an update on a commentary I wrote a few months ago. In that commentary, I looked at historical times for the Russell 2000 Index, which represents U.S. small stocks. I noted where the monthly return had, at a minimum, a 15% loss and then looked at the return for the next three months, twelve months, and three years. This means I was not showing data from the bottom of the market but rather trying to be consistent and look at the first point in time where the market had at least a 15% loss. I wanted to update that data, but this time look at when the Russell 2000 had at minimum, at least a 25% loss. Below are the results.

Data source: Morningstar. Data calculations source: Elevate. Through September 30, 2022.

Here’s what stood out:

- The future is unknown: Just because the average one-year return was +37% after the market was down 25% does not mean that will happen today. The market could very well continue to go down. Look at October 2008. U.S. small stocks were down at least 25%, then the next 12 months ended up down 5%.

- Don’t get caught up in the emotion of fear: It is important to understand that the annualized return since January 1976 for U.S. small stocks was +6.5%, but the average 1-year return after a 25% decline was +37%, and the average 3-year annualized return was +16%. It was beneficial for investors to not get caught up in the emotion of fear when the market was going down but rather to be contrarian.

This year has not been easy and has felt more painful. However, as I said, that is now the past, and all we can do is focus on the future. Frontier is looking at everything they can each month to try and keep a certain level of risk but, more importantly, looking for opportunities. During times of downturn, opportunities usually arise. The idea of all of this was to show you that if this felt painful, you were right and not alone. But, if the future is like the past, you can see that in the long-term things tend to be better after times of pain.

About Jim

Jim Shellenberger, CFA, CFP® is a financial advisor at Elevate Wealth Management, an independent, fee-only wealth management firm serving young professionals, pre-retirees, and retirees in Sheridan, Wyoming, and surrounding areas. With the mission of serving and educating, Jim is dedicated to providing comprehensive, top-notch services that not only help his clients reach their goals, but also empower them to make the best financial decisions for their lives and walk toward their future with confidence. Jim is known for going the extra mile, not only offering valuable knowledge in investment management as a former investment analyst, but building long-lasting relationships so he can give honest, customized advice and strategies that make an impact on their lives.

Jim has a bachelor’s degree in business administration with a minor in finance from the University of Wyoming. He is proud to be a Wyoming native and loves exploring the outdoors with his family—hiking, fishing, hunting, and backpacking. Faith is an integral part of Jim’s life, and he always looks forward to attending church on Sundays, Bible study on Fridays, and being part of his church community. He’s also an avid sports fan! Fun fact: Jim owns shares in the Green Bay Packers. To learn more about Jim, connect with him on LinkedIn.

Past performance is no guarantee of future returns. Nothing presented herein is or is intended to constitute investment advice or recommendations to buy or sell any types of securities and no investment decision should be made based solely on information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for an s investor’s financial situation or risk tolerance. Diversification and asset allocation do not ensure a profit or protect against a loss. All performance results should be considered in light of the market and economic conditions that prevailed at the time those results were generated. Before investing, consider investment objectives, risks, fees and expenses.

Frontier does not directly use economic data as a part of its investment process.

Information provided herein reflects Elevate’ s views as of the date of this newsletter and can change at any time without notice. Elevate obtained some of the information provided herein from third party sources believed to be reliable, but it is not guaranteed, and Elevate does not warrant or guarantee the accuracy or completeness of such information. The use of such sources does not constitute an endorsement. Elevate’ s use of external articles should in no way be considered a validation. The views and opinions of these authors are theirs alone. Reader accesses the links or websites at their own risk. Elevate is not responsible for any adverse outcomes from references provided and cannot guarantee their safety. Elevate does not have a position on the contents of these articles. Elevate does not have an affiliation with any author, company or security noted within. Elevate reserves the right to remove these links at any time without notice.

Exclusive reliance on the information herein is not advised. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell any securities, commodities, treasuries or financial instruments of any kind. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, investment or tax advice.

Elevate Wealth Management is the Financial Planning division of Frontier Asset Management and is wholly owned and operated by the firm. Frontier Asset Management is a Registered Investment Adviser with the U.S. Securities and Exchange Commission; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Frontier and its investment adviser representatives is available on the SEC’s website at www.adviserinfo.sec.gov.

Frontier’s ADV Brochure and Form CRS are available at no charge by request at info@frontierasset.com or 307.673.5675 and are available on our website www.Frontierasset.com. They include important disclosures and should be read carefully.

It is generally not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any) based on that index. 101022DWM101023

Other Commentary

If you liked this commentary, you may enjoy some other commentary we have done in the past.