“I wanna hold you close but never hold you back, just like the banks of the river” – NEEDTOBREATHE

Jim Shellenberger, CFA, CFP® | Financial Advisor

This song is intended as a message from the artist to his wife in a song called “Banks.” I think this is also an excellent message for our investment accounts. If we want our investment accounts to grow in the long run, sometimes, we need to not get in the way. Instead, we need to be like the banks of a river and help guide our investments. We shouldn’t be naive about what is happening, but we must constantly check ourselves to ensure we provide gentle guidance versus making drastic decisions in times of volatility.

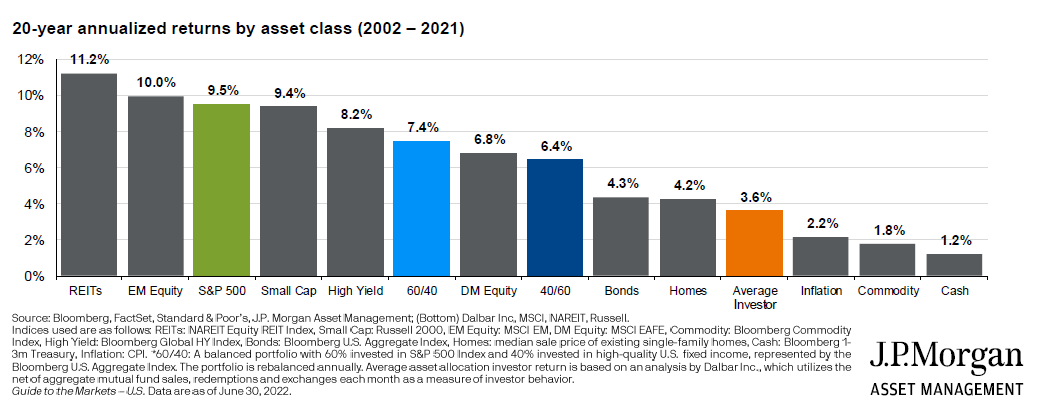

1. How has the average investor done in the past?

J.P. Morgan has an interesting chart that shows the annual return for the 20 years ending 2021 for different asset classes, investment approaches, and the average investor. Take a look at the difference between the average investor, a 60/40 portfolio and a 40/60 portfolio. A 60/40 portfolio in this situation is 60% S&P 500® and 40% high-quality U.S. fixed income, represented by the Bloomberg U.S. Aggregate Bond Index. The 40/60 is the opposite.

As you can see, the average investor underperformed the 60/40 by 3.8% per year, which would be a total return difference of 111% over those 20 years. At the same time, the average investor underperformed the 40/60 by 2.8% a year, which is a total return difference of 74% over that time. This shows that the average investor’s decisions end up hurting them more than helping compared to choosing an investment strategy and sticking to it over a long period. Many investors out there have likely fallen victim to this, me included.

2. The current investment environment has not been enjoyable in 2022

In Ben Carlson’s blog, “A Wealth of Common Sense”, there was a recent interesting article on the first six months of 2022. Here are the four points that really stood out to me¹

1. The period ending June 30, 2022 ranks in the worst 3% of all six-month returns since 1926.

2. The -7.4% return on 5-year government bonds through May 31, 2022 was the second worst six-month return ever.

3. The six-month returns for a 60/40 portfolio were in the bottom 2% of rolling returns going back to 1926.

4. It was also just the fourth time over the past 100 years or so that stocks and bonds were down two quarters in a row at the same time.

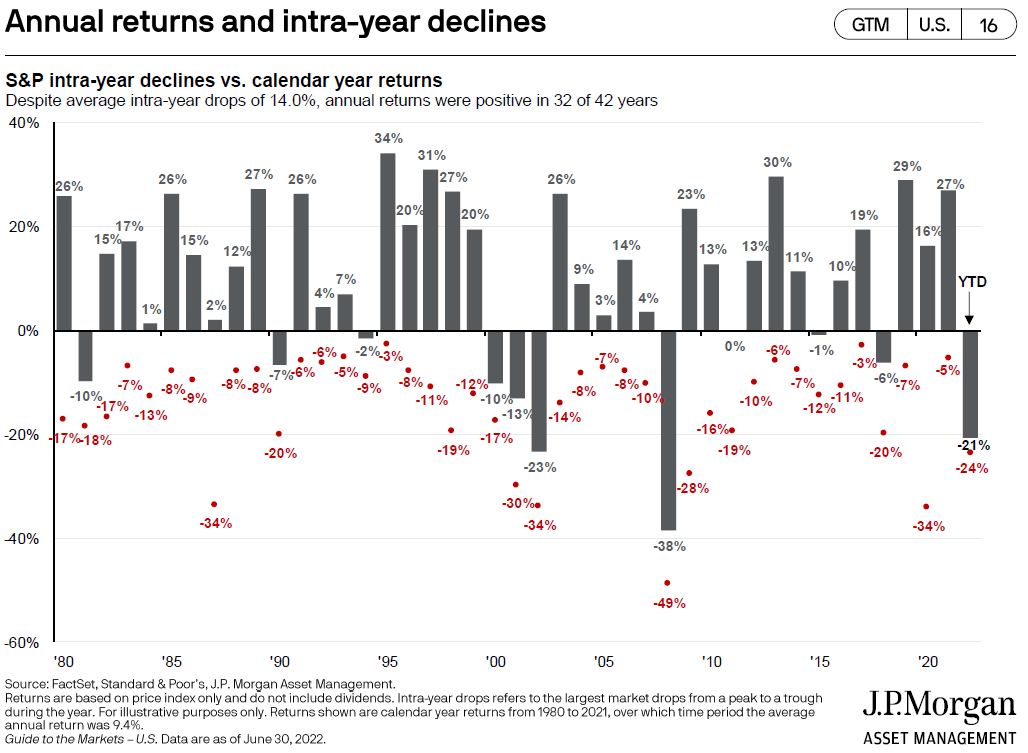

That is not fun to read. As we keep hearing, we are living through historic times and not the type of landmark times we want to live through. Now the silver lining to this, if there is one, is that we made it through this. We’re surviving; even if it was painful, we did survive. And while these stats are hard to hear, it is not abnormal for there to be drawdowns in the stock market every year.

We must remember that these stats for 2022 are historical information now. We cannot look backward; instead, we need to look forward.

3. What are some things we can look to for future hope?

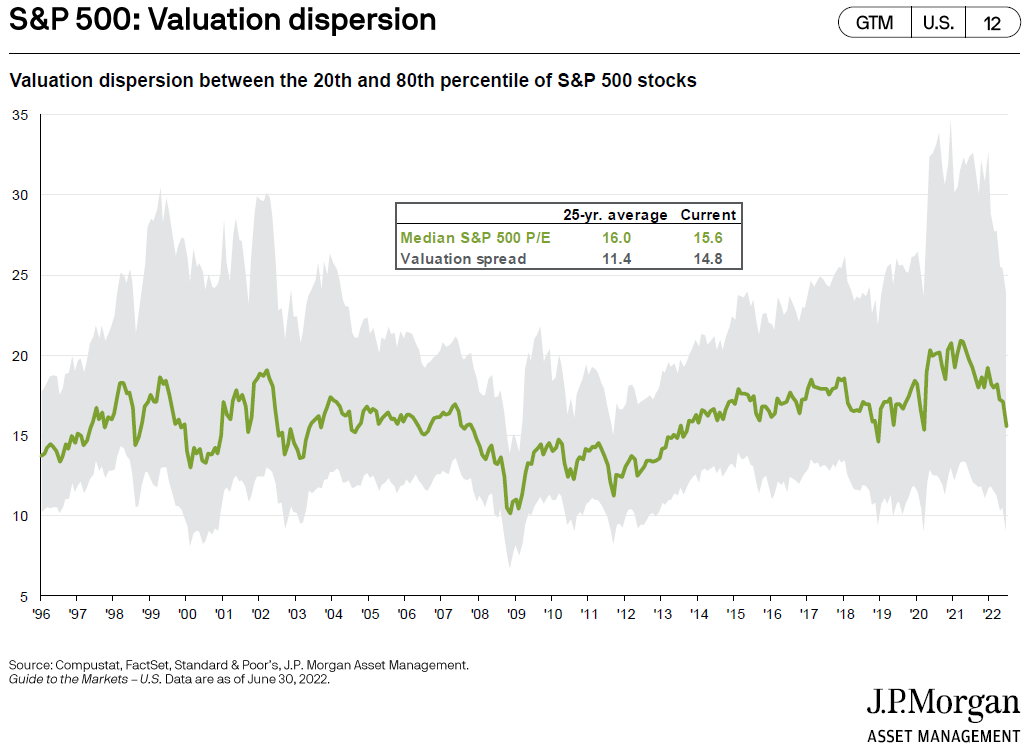

When the market has gone down, there is a good chance that forward looking return expectations are higher than they were before a downturn. I admit there are a lot of J.P. Morgan charts in this commentary as they came out with a “Guide to the Markets” last month that had some great visuals to show. Below is a chart showing the current forward price-to-earnings (P/E) ratio for the S&P 500 and what it has been historically. This is a good chart to look at because the P/E ratio gives us an idea of how expensive or discounted the stock market is. The lower the ratio, the less expensive the stock market is and vice versa. The more discounted it is, the higher the return expectations should be going forward. You can see that we have come into a more reasonable territory for the forward P/E.

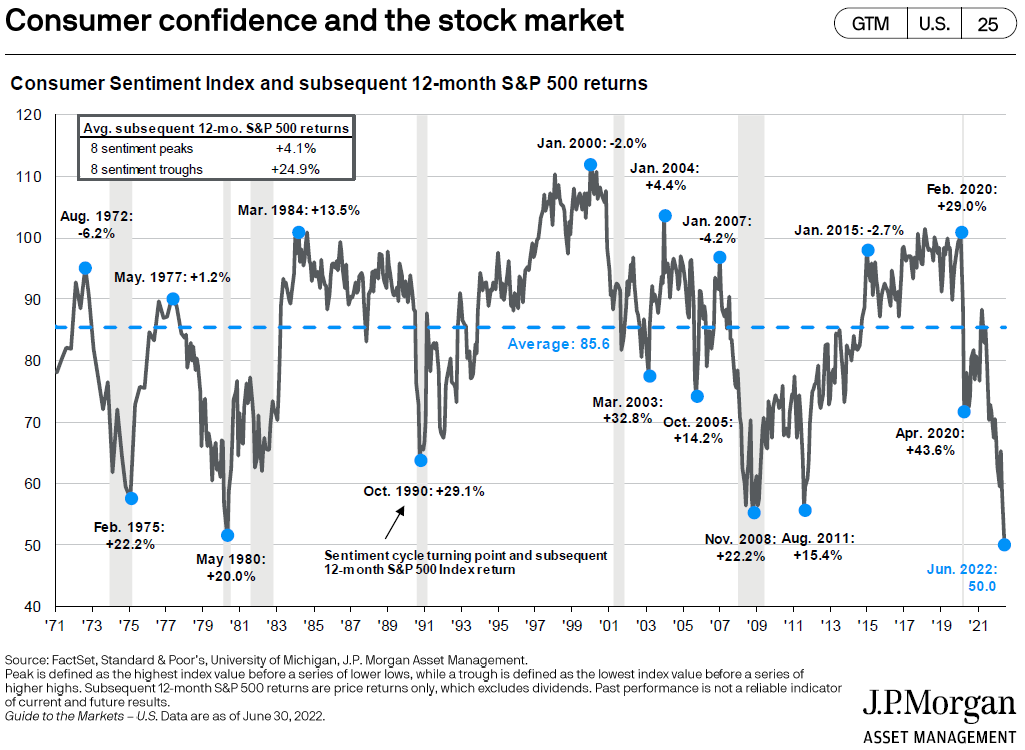

You may get tired of hearing me say this, but I truly believe one of the best ways of thinking about investing is to think contrarian. As Warren Buffet said, “Be fearful when others are greedy, and greedy when others are fearful.” The chart below shows what consumer sentiment has looked like over time. The part I enjoy is that you can see in the top left what the subsequent 12-month return for the S&P 500 has been after a consumer sentiment peak or trough. The average return was much higher after consumer sentiment hit a low versus when it hit a high—illustrating the benefit of thinking like a contrarian. Right now, consumer sentiment is very low. We can hope with this, along with valuations being much more reasonable, that things could be better in the future. However, there are no guarantees of what will happen in the stock market.

Remember, the stock market can be irrational longer than you can be rational. However, stick to what you know. We know that the average investor has done worse than a stick it and leave it 60/40 or 40/60 portfolio in the last 20 years. We also know that stock market drawdowns happen, valuations look more reasonable, and the sentiment is low. We want to pay attention to what is happening, but once again, we want to be like the banks of the river and not make drastic decisions at times of uncertainty.

1 Carlson, Ben. “The Worst 6 Months Ever for Financial Markets.” A Wealth of Common Sense, 3 July 2022,

About Jim

Jim Shellenberger, CFA, CFP® is a financial advisor at Elevate Wealth Management, an independent, fee-only wealth management firm serving young professionals, pre-retirees, and retirees in Sheridan, Wyoming, and surrounding areas. With the mission of serving and educating, Jim is dedicated to providing comprehensive, top-notch services that not only help his clients reach their goals but also empower them to make the best financial decisions for their lives and walk toward their future with confidence. Jim is known for going the extra mile, not only offering valuable knowledge in investment management as a former investment analyst but building long-lasting relationships so he can give honest, customized advice and strategies that make an impact on their lives.

Jim has a bachelor’s degree in business administration with a minor in finance from the University of Wyoming. He is proud to be a Wyoming native and loves exploring the outdoors with his family—hiking, fishing, hunting, and backpacking. Faith is an integral part of Jim’s life, and he always looks forward to attending church on Sundays, Bible study on Fridays, and being part of his church community. He’s also an avid sports fan! Fun fact: Jim owns shares in the Green Bay Packers. To learn more about Jim, connect with him on LinkedIn.

* Chartered Financial Analyst® trademark is the property of the CFA Institute

Information provided herein reflects Frontier’s views as of the date of this newsletter and can change at any time without notice. Frontier obtained some of the information provided herein from third party sources believed to be reliable, but it is not guaranteed, and Frontier does not warrant or guarantee the accuracy or completeness of such information. The use of such sources does not constitute an endorsement. Frontier’s use of external articles should in no way be considered a validation. The views and opinions of these authors are theirs alone. Reader accesses the links or websites at their own risk. Frontier is not responsible for any adverse outcomes from references provided and cannot guarantee their safety. Frontier does not have a position on the contents of these articles. Frontier does not have an affiliation with any author, company or security noted within. Frontier reserves the right to remove these links at any time without notice.

Exclusive reliance on the information herein is not advised. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell any securities, commodities, treasuries or financial instruments of any kind. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, investment or tax advice. Frontier does not directly use economic data as a part of its investment process.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. The estimates, including expected returns and downside risk, throughout are calculated monthly by Frontier and will change from month to month depending upon factors, including market movements, over which Frontier has no control. They are only one factor among many considered in Frontier’s investment process and are provided solely to offer insight into Frontier’s current views on long-term future asset class returns. They are not intended as guarantees of future returns and should not be relied upon in making investment decisions.

Elevate Wealth Management is the financial planning division of Frontier Asset Management. Frontier Asset Management is a Registered Investment Adviser. The firm’s ADV Brochure and Form CRS are available at no charge by request at info@frontierasset.com or 307.673.5675 and are available on our website www.frontierasset.com. They include important disclosures and should be read carefully.

It is generally not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any) based on that index.

The S&P 500 index consists of U.S. Large Cap Equities, which is a market-value-weighted index of 500 stocks that are traded on the NYSE, AMEX, and NASDAQ.

The price-earnings ratio (P/E Ratio) is the ratio of a company’s share (stock) price to the company’s earnings per share. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued.

Carlson, Ben. “The Worst 6 Months Ever for Financial Markets.” A Wealth of Common Sense, 3 July 2022, https://awealthofcommonsense.com/2022/07/the-worst-6-months-ever-for-financial-markets. 071922DWM103122

Other Commentary

If you liked this commentary, you may enjoy some other commentary we have done in the past.