“Grandpa, tell me ’bout the good old days” – The Judds

Jim Shellenberger, CFA, CFP® | Financial Advisor

We don’t need to talk to Grandpa to remember the beginning of 2020. For some of us, it may feel like a lifetime ago with all that has taken place since. However, that was only two and a half years ago. I had to double-check to ensure that was right because it felt much longer to me. Even though a lot has happened in that time, a lot is happening right now that can scare people. I want to remind you about the market and try to expand your focus beyond 2022.

1. It helps to take a longer perspective on the market.

Pain felt in the market is often related to where you are now versus what the high-water mark was. Another way to say that is that pain is felt based on the highest dollar amount your account reached at one point in time versus where it is today. This is a very understandable rationale. Interestingly, we know that investing can be volatile, so we shouldn’t take the high-water mark as a given when we look at our account. Instead, we should look back over a few years and see where we have come from. For example, if your account went from $100,000 to $150,000 in a year and then down to $125,000 the following year, you would probably be excited in year one and then feel pain in year two. Now, what about a different scenario. What if your account went from $100,000 to $112,500 in year one and then up to $125,000 in year two? I would guess most of us would be content with a constant return that got us to $125,000.

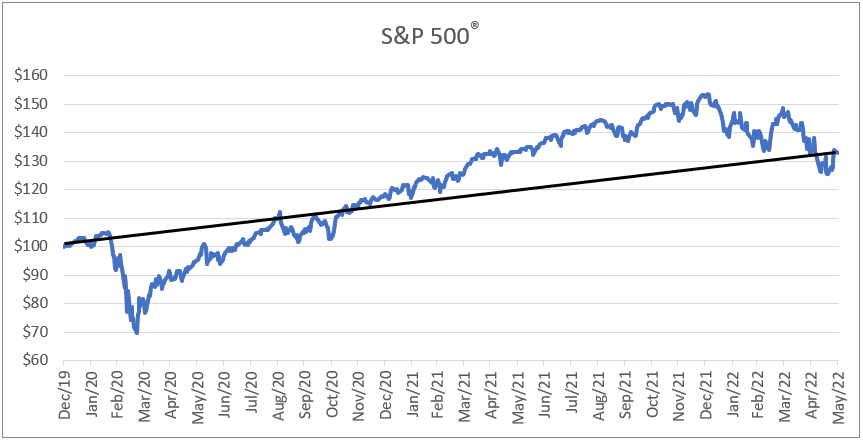

Interestingly, in both of those scenarios, you started with the same amount and ended up with the same amount. If you had never known your account hit $150,000 and came down in scenario one, you might have been all right emotionally – and felt less pain. I don’t think this is too different from what is happening today. Below is a dollar growth chart showing the S&P 500®, which represents U.S. large cap stocks, since January 2020.

Source: Morningstar. Calculations by Frontier.

Source: Morningstar. Calculations by Frontier.

The total return from January 2020 to the end of May 2022 has been about 33%. That is not too bad. If we try and take a longer time frame, which I would argue should be even longer than the chart above, it helps put things into perspective.

2. Volatility is back, so please don’t try timing the market.

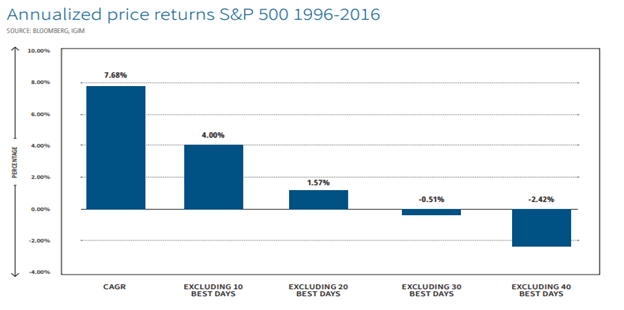

It can be scary to see U.S. large-cap stocks down 3% one day and up 3% the next. At times like this, it is natural to want to understand what is happening and make the “perfect” move for your portfolio. There are many names for it, but in the end, it is an attempt to time the market. This is a typical thought process. Most of us, even financial professionals, try it.. We know it isn’t right but rarely know why. In a white paper called “Time in the market, not timing the market, is what builds wealth,” Stephen Rogers of Investors Group discusses the effect of trying to time the S&P 500, which is just one of many asset classes in the overall market. The most convincing numbers are represented in the figure below.

This figure shows the annualized returns of the S&P 500 for 20 years from 1997 to the end of December 2016. You can see that the S&P 500 returned 7.68% annually for those 20 years. If you were to exclude the 20 best days in that 20-year time, which has over 5,000 trading days, your annualized return would have dropped from 7.68% to 1.57%. The interesting part is that most of those 20 best trading days took place during a market downturn – the times we are getting out or wanting to get out of the market.

This figure shows the annualized returns of the S&P 500 for 20 years from 1997 to the end of December 2016. You can see that the S&P 500 returned 7.68% annually for those 20 years. If you were to exclude the 20 best days in that 20-year time, which has over 5,000 trading days, your annualized return would have dropped from 7.68% to 1.57%. The interesting part is that most of those 20 best trading days took place during a market downturn – the times we are getting out or wanting to get out of the market.

3. It is understandable why this may feel worse than other recent downturns.

During most downturns, we would expect bonds to help soften the blow. For example, from January 2020 to the end of April 2020, U.S. large stocks were down about 9%, and U.S. aggregate bonds were up about 5%. Looking at this year, from the beginning of January to the end of May, U.S. large stocks were down about 13%, and U.S. aggregate bonds were down about 9%. This means that some of the fundamentals of diversification (e.g. bonds) have not helped in softening the downturn. It doesn’t feel enjoyable, but it is the reality of what has happened this year. On a better note, just because that happened January through May does not mean that it will happen going forward.

Investing will involve the “good days” and days of pain. That can be the reality of investing. Now that doesn’t make the pain any easier, but hopefully, we can find ways to help. The good, old solution is to not check your account or markets daily. Instead, take a longer perspective when looking at your accounts and where you have come from. If you have any questions about the investment world, especially right now, please do not hesitate to reach out.

Rogers, Stephen (2017) Time in the market, not timing the market, is what builds wealth. Investors Group Inc.

The S&P 500 index consists of U.S. Large Cap Equities, which is a market-value-weighted index of 500 stocks that are traded on the NYSE, AMEX, and NASDAQ.

It is generally not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any) based on that index.

Frontier’s use of external sources should in no way be considered an endorsement. Reader accesses sources at their own risk. Frontier is not responsible for any adverse outcomes from sources provided and cannot guarantee their safety. Frontier does not have a position on the contents of the site sources. Frontier does not have an affiliation with any author, company, or security noted within. Frontier reserves the right to remove these links at any time without notice. It is generally not possible to invest directly in an index. Exposure to any asset class or trading strategy or other category represented by any index is only available through third party investable instruments (if any) based on that index.

Nothing presented herein is or is intended to constitute investment advice or recommendations to buy or sell any types of securities and no investment decision should be made based solely on information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for an s investor’s financial situation or risk tolerance. Diversification and asset allocation do not ensure a profit or protect against a loss. All performance results should be considered in light of the market and economic conditions that prevailed at the time those results were generated. Before investing, consider investment objectives, risks, fees and expenses. Frontier may modify its process, opinions and assumptions at any time without notice as data is analyzed.

© Morningstar 2022. All rights reserved. Use of this content requires expert knowledge. It is to be used by specialist institutions only. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

For Advisor and Investor Use

061722DWM103123

Other Commentary

If you liked this commentary, you may enjoy some other commentary we have done in the past.