“It’s hard to be humble, when you’re perfect in every way.” – Mac Davis

Jim Shellenberger, CFA | Financial Advisor

I first heard “It’s Hard to Be Humble,” performed by Willie Nelson, but later discovered that Mac Davis is the original singer / song writer. If you haven’t heard it, give it a listen – it may provoke a laugh or two. As an investor, the lyrics hit close to home. It is easy to get caught up in trying to make decisions be “perfect in every way.” Don’t get me wrong: it is crucial we investors make the best possible decisions we can. But looking back, it’s equally important to remember that we make them with the (limited) information we have available to us and understand that the decisions won’t always be perfect – and that that’s okay. And let’s be honest here: if investors were able to make ideal investment decisions consistently, we would all be extraordinarily wealthy. Or we would be writing a gazillion books on investing. But there is a chance that we might not even bother to write, and we would simply enjoy the fruits of our investments.

What if we tried timing our annual contributions? I did some research to see the difference between what the general consensus says is “good” timing of contributions versus what’s considered “bad” timing. To do this, let’s set up the premise. We will be investing in the S&P 500®1. Let’s create two different scenarios and call them, very inventively, “Good Timing” and the other – wait for it – “Bad Timing.” Each year, we’ll have $1,000 to either invest or put aside in cash to invest in a subsequent year. To decide if we invest or not, we will look at the previous year’s performance. In the years that you do not invest in the S&P 500®1, the cash is held until there is a negative returning year and all previous years’ cash savings are then invested.

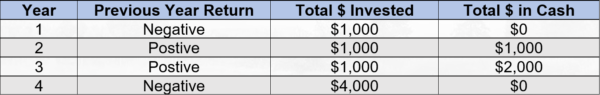

For the “Good Timing” scenario, if the previous year’s performance has been negative, we will invest because we are trying to buy low. If the previous year’s return has been positive, we will keep the $1,000 in cash until we have a year of negative performance, which is when we invest all the cash we have on hand. Here is a visual of what that looks like:

*Does not consider any return on investment.

The “Bad Timing” scenario will be the opposite. We will invest only if the return the year before has been positive, and we will put the money in cash if the previous year’s return has been negative. An approach like this seems wrong because, in theory, we should want to invest cash when the S&P 500® is low, which would happen after a negative return year.

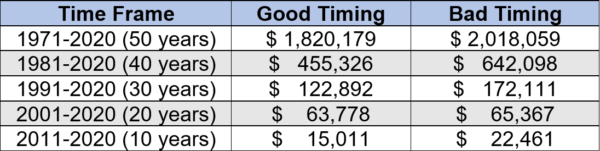

If you are anything like me, the results will shock you. The table below shows the ending dollar amount for various time periods.

As you can see, the “Bad Timing” scenario did better than the “Good Timing” scenario in all five of the time periods. The result may seem perplexing at first, but give it a closer look, and it makes sense. In my opinion, for long-term investors, I would take time in the market over timing the market any day.

The S&P 500®, which we looked at for these scenarios, was up 80% of the years from 1971 to 2020. This means that the “Bad Timing” scenario was spending more time invested (since they invested the cash only in years where the previous return was up) than not. You might have guessed that the “Good Timing” scenario would have done better. I sure did. But alas, it all goes back to time in the market beating timing the market.

Who is the ultimate winner? If the phrase holds true, then we should look at one more variable. What if we invested the $1,000 of cash each year, no matter the previous year’s return? Well, lo and behold: this scenario beats both the “Good Timing” and the “Bad Timing” scenarios for all five time periods.

Investing can be scary if we feel that the market is overvalued or when the market return is negative, and we don’t know if it will keep going down or not. However, since investing $1,000 a year – regardless of performance – beats the other options, one would conclude that it is beneficial to put aside emotional biases and stick to a constant contribution plan. So let us be humble and realize we may not be perfect in every decision we make, yet still keep investing, using the best, most up-to-date information we have available to us.

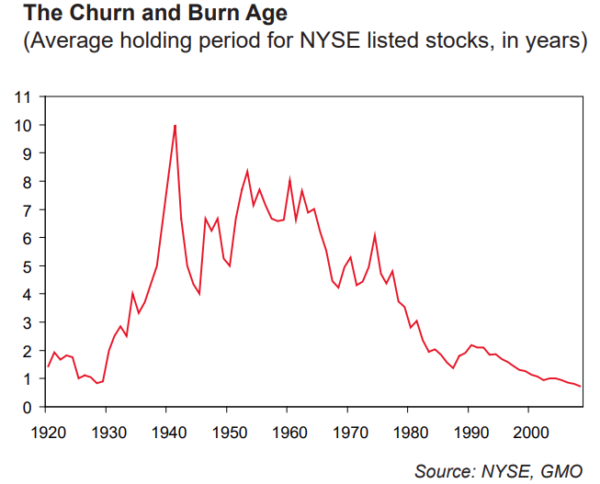

Patience in investing is important. Warren Buffet, CEO of Berkshire Hathaway, is a big advocate for being patient when investing. I often remind myself of his wise words that, “the stock market is a device to transfer money from the impatient to the patient.” With the information overload we have nowadays, it is easy to constantly feel the need to make changes to arrive at the “perfect” financial decision. We can see these changes being made over time when we look at the average holding period for an NYSE-listed stock. Back in the 1970s, the holding period averaged about 5-6 years. Nowadays, it is closer to one year. To me, below is an impressive visual of what happens when chasing perfection and an abundance of information collide.

You may have noticed something incredible by looking at the “Good Timing” and “Bad Timing” scenarios. If an investor had started investing $1,000 a year in 1971, they would have only invested $50,000 over that time, but their account would be worth about $2 million. Not a bad payoff for being patient. I realize that it is way more fun telling people about the big, bold investment decisions you make, rather than saying, “oh, my strategy is to invest $1,000 at the beginning of each year.” But I would argue that it is even more fun to tell people how much that $1,000 a year investment could turn into over time.

At the beginning of the chorus, Mac Davis sings, “Oh Lord, it’s hard to be humble when you’re perfect in every way.” He ends the chorus with, “Oh Lord, it’s hard to be humble, but I’m doing the best that I can.” We investors would be wise to do the same and to keep investing patiently.

[1] This example is for illustration purposes only. Frontier does not recommend investing in a single asset class or product. It is not possible to invest directly in the S&P 500 Index.

Ready to talk?

Please reach out to set up an appointment.

Past performance is no guarantee of future returns. Nothing presented herein is or is intended to constitute investment advice or recommendations to buy or sell any types of securities and no investment decision should be made based solely on information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for an s investor’s financial situation or risk tolerance. Diversification and asset allocation do not ensure a profit or protect against a loss. All performance results should be considered in light of the market and economic conditions that prevailed at the time those results were generated. Before investing, consider investment objectives, risks, fees and expenses. Please contact a tax professional for advice on your individual circumstances and tax consequences.

Information provided herein reflects Elevate’ s views as of the date of this newsletter and can change at any time without notice. Elevate obtained some of the information provided herein from third party sources believed to be reliable, but it is not guaranteed, and Elevate does not warrant or guarantee the accuracy or completeness of such information. The use of such sources does not constitute an endorsement. Elevate’ s use of external articles should in no way be considered a validation. The views and opinions of these authors are theirs alone. Reader accesses the links or websites at their own risk. Frontier is not responsible for any adverse outcomes from references provided and cannot guarantee their safety. Elevate does not have a position on the contents of these articles. Elevate does not have an affiliation with any author, company or security noted within. Elevate reserves the right to remove these links at any time without notice.

Exclusive reliance on the information herein is not advised. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell any securities, commodities, treasuries or financial instruments of any kind. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal, investment or tax advice.

Information provided herein reflects Elevate’ s views as of the date of this newsletter and can change at any time without notice. Elevate obtained some of the information provided herein from third party sources believed to be reliable, but it is not guaranteed, and Elevate does not warrant or guarantee the accuracy or completeness of such information.

Elevate Asset Management is wholly owned and operated by Frontier Asset Management, LLC. Frontier’s ADV Brochure iand Form CRS are available at no charge by request at info@frontierasset.com or 307.673.5675. The ADV Brochure contains important disclosure information and should be read carefully.

It is generally not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any) based on that index.

| INDEX | INDEX DESCRIPTION |

| S&P 500® | Represents US large company stocks. It is a market-value-weighted index of 500 stocks that are traded on the NYSE, AMEX, and NASDAQ |

041621CST033122